What Is An Annuity?

Buying an annuity is one way to help build your retirement assets. Annuities offer principal protection and potential interest to help you accumulate money for your retirement. The money in your annuity can grow tax-deferred, which may help your savings accumulate faster.

More options as you plan for retirement

Throughout your working life, you've focused on saving money for retirement. Now, you're also thinking about how to spend it.

Today we can expect to live longer, more active lives after we stop working than any generation before us. But as our retirement horizons expand, so do our financial needs.

Mind the income "gap" to maintain your lifestyle

Most of us will face an “income gap” when we retire. This is the difference between what you’ll receive from Social Security, a pension if you have one, and any other sources of guaranteed income …and what’s needed to meet expenses and maintain the lifestyle you want. An annuity can solve this problem by converting a portion of your personal savings and investments into a stream of income you can count on.

What's the Best Choice

for You?

Traditionally, consumers purchased annuities to

gain financial security and the potential to grow

their retirement money. Although growth and

protection remain their primary goals, today’s

annuities have evolved. Increasingly, annuities

are designed to:

Help consumers grow their money without risk

Create a stream of guaranteed lifetime income

Because retirement is different for everyone, there

are many things you should consider and many

annuity options. Discuss your retirement timing and

goals, your risk tolerance, and other factors before moving forward with an annuity.

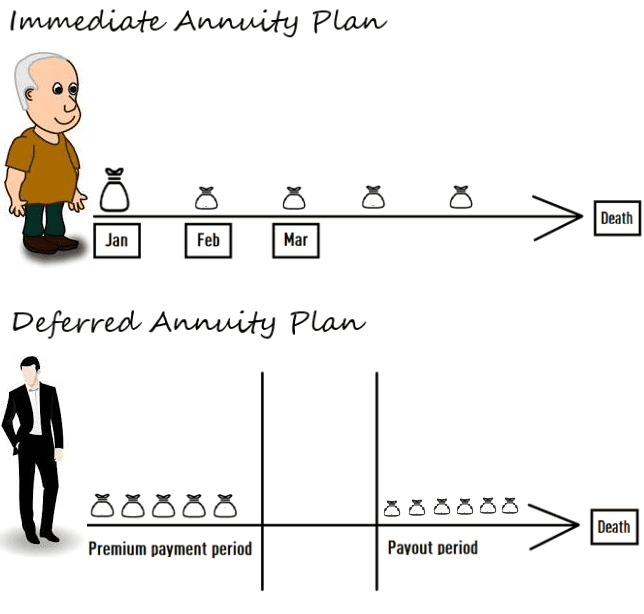

Fixed Immediate Annuity

A fixed immediate annuity allows you to turn a one-time, lump sum payment into a guaranteed series of payouts.

Fixed immediate annuities offer:

- Guaranteed payouts which generally begin within one year of your contract date and can be spread over a specified period of time of your choosing, or even for life

- The choice of a guaranteed income plan that fits your situation, with no market volatility to worry about or portfolios to manage

Some fixed immediate annuities may also allow you to receive future annuity payments in advance as a lump sum before they are due to be paid to you — providing additional access should the need arise. However, these options may significantly affect future periodic payments.

Fixed Deferred Annuity

A fixed deferred annuity allows you to turn a lump sum or continuous payment into a guaranteed series of payouts after a set number of years.

Fixed deferred annuities offer:

- Provide a guaranteed minimum interest rate that allows your money to grow tax deferred

- Generally are considered to be lower risk and can guarantee retirement income that you can’t outlive

Many contracts include benefits such as a bailout feature, return of premium, and longer rate guarantees. So, in addition to the interest, interest rate period, and surrender charge period, you should carefully consider all the features provided by the contract.

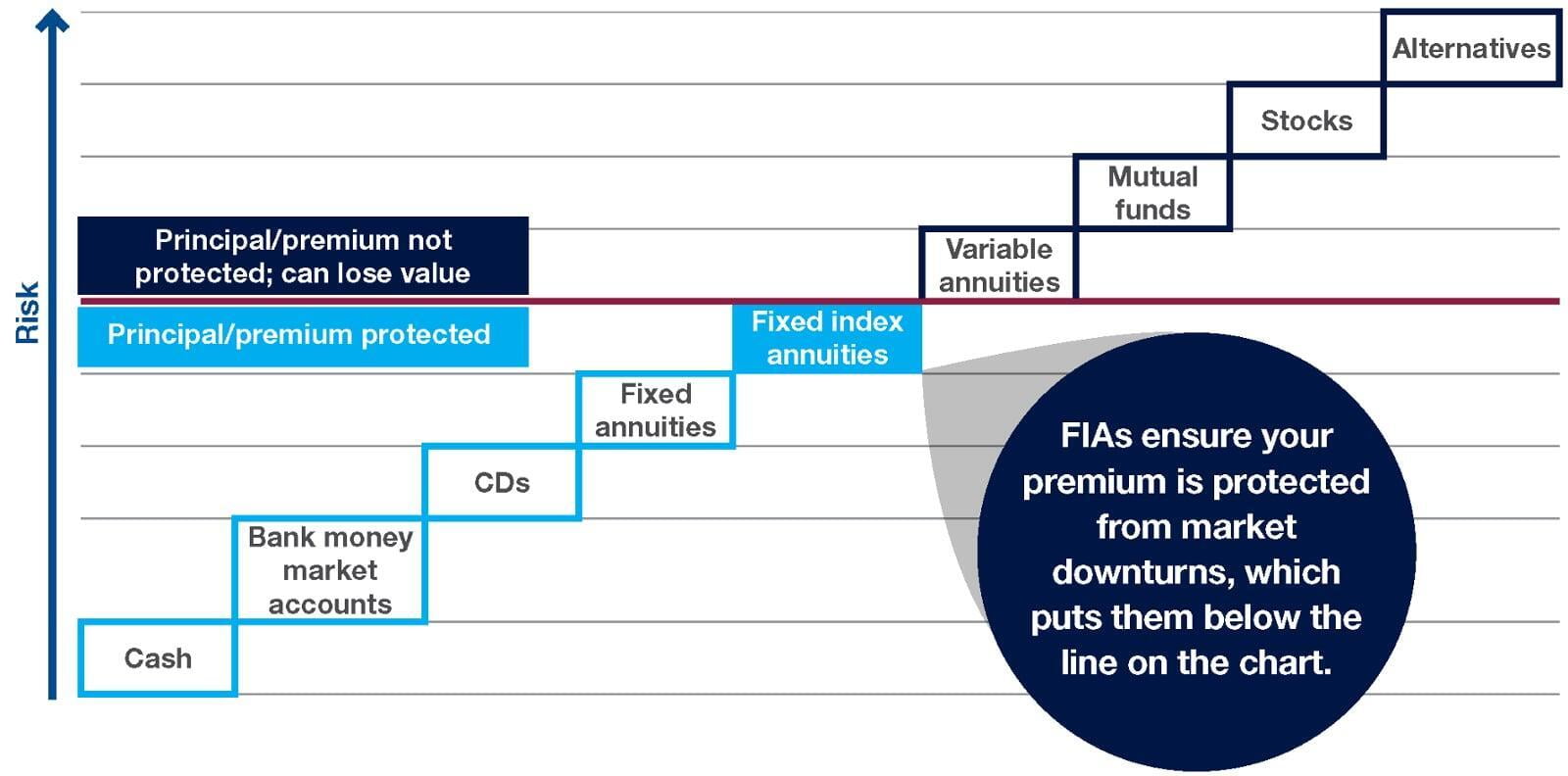

Fixed Index Annuities

Fixed index annuities operate in a way similar to traditional fixed deferred annuities and share many of their benefits.

What makes a fixed index annuity different is the opportunity to have interest crediting linked to the performance of one or more well know market index, such as the S&P 500® Index.

In addition to interest crediting linked to the performance of an index, you also have the ability to choose a fixed rate interest crediting strategy. Further, you can reallocate each year.

Performance based on market index is different than being tied directly to the performance of a bond, equity, or similar investment. Insurers offering fixed index annuity contracts credit interest based on price changes of a selected index.

The credited amount is typically capped, which limits interest at both a particular high point and at a floor that guarantees contract value will never be lost due to a decline in the index. However, depending on the crediting strategy, it’s possible that no interest will be credited to the contract during a particular time period.

Over time, fixed index annuity contract values may grow more than a traditional deferred fixed annuity.